Tired of watching your portfolio lose value? Then maybe it’s time to invest in a championship boxing belt, a vintage comic book or a 40-year-old Scotch whisky. In 2021, Bottom Line Personal highlighted the investment phenomenon that allows small investors to invest in high-priced collectibles that typically only millionaires could afford. How it works: Online investment companies acquire rare items, then offer fractional ownership shares to the public. When the collectible is eventually sold at auction or to a private buyer, the investors earn a portion of the profits through their appreciated shares. Betting on these collectibles entails plenty of risk, but it also may be a viable alternative investment for long-term investors.

Below are collectible categories that fractional-shares expert Michael Fox-Rabinovitz, CFA, says are doing well now…and those to avoid.

What’s out: Vintage videogames…music memorabilia…rare cars…NFT artwork (unique digital assets).

What’s in: Whisky and wines, comic books and sports memorabilia…

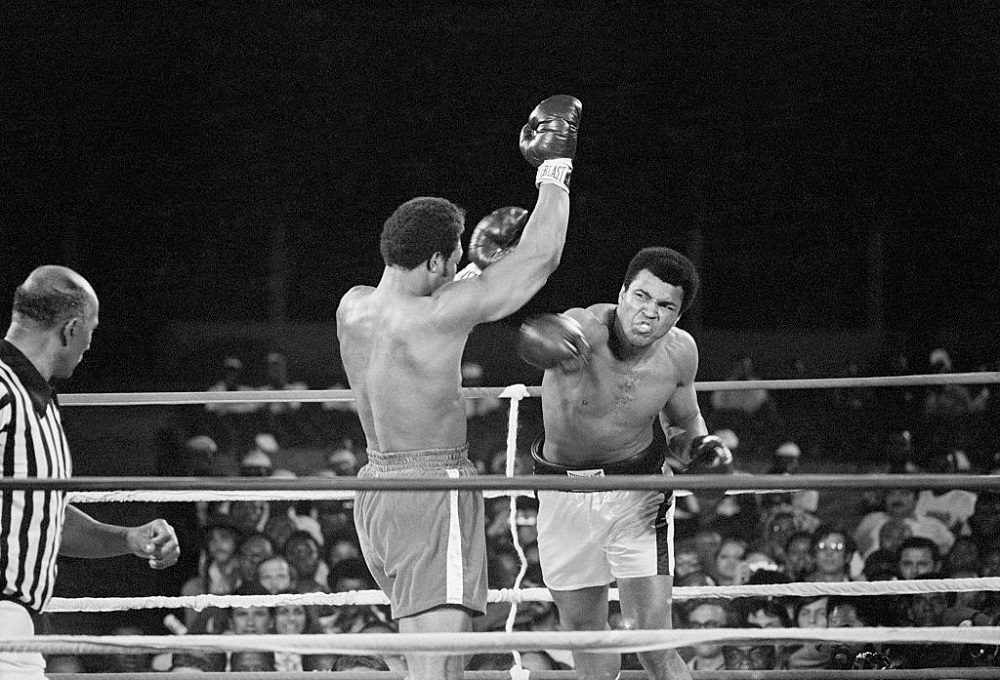

1974 championship belt awarded to Muhammad Ali by the World Boxing Council for his “Rumble in the Jungle” win over George Foreman. Recent share price: $13.70. Performance since IPO: 57%. Collectable.com

Bottle of Macallan 40-year-old Scotch single-malt whisky. Recent share price: $9. Performance: 50%. RallyRD.com

1962 Marvel Comics book, Fantastic Four #5—featuring Doctor Doom’s first appearance. Recent share price: $11.85. Performance: 48%. RallyRD.com